How Smart Business Owners Take Control of Their Finances — Without Wasting Time on Bookkeeping

Let’s be honest: You didn’t start your business to spend hours sorting receipts, chasing numbers, or stressing over monthly reports.

But here’s the truth: what you don’t know about your finances can hurt your business. Missed HST filings, inaccurate reports, late CRA responses — they all cost time, money, and peace of mind.

The good news? You don’t have to do it alone.

We’ve helped hundreds of Canadian business owners simplify their bookkeeping and regain control of their numbers — without spreadsheets, confusion, or anxiety.

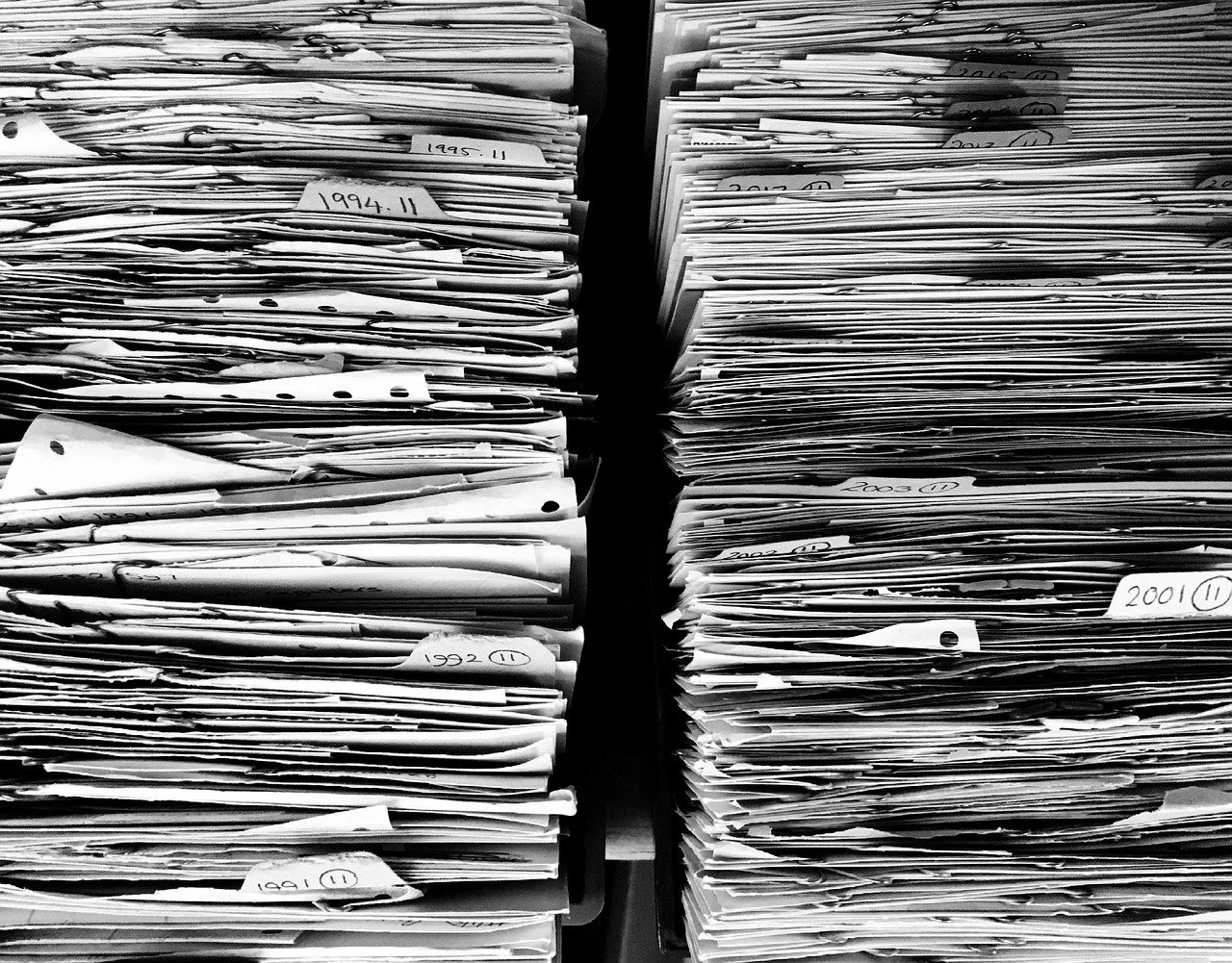

The Hidden Pain of DIY Bookkeeping

Most entrepreneurs don’t realize the real cost of disorganized or delayed bookkeeping until it hits them:

❌ Missed tax deductions

❌ Late filing penalties

❌ Inaccurate financial decisions

❌ Cash flow issues

❌ CRA letters you don’t know how to respond to

Even worse? You’re stuck doing it all after hours when you should be building your business — or living your life.

The Emotional Cost: Stress, Uncertainty, and Second-Guessing

It’s not just numbers — it’s how those numbers make you feel:

"Am I even profitable?"

"Why does it feel like there’s never enough cash?"

"What if the CRA comes calling?"

Sound familiar?

Bookkeeping anxiety is real — but it doesn’t have to be your reality.

The “Afters”: What Your Business Looks Like with Monthly Maintenance

Imagine this:

📊 You get monthly Profit & Loss reports — delivered automatically.

🧾 GST/HST is filed on time, every time — no penalties, no stress.

💬 You get fast answers to your questions — from someone who knows your books.

📁 Your records are CRA-ready, without you lifting a finger.

💼 You know exactly where your business stands — and where it’s going.

That’s the power of outsourcing your monthly bookkeeping to professionals who get Canadian small businesses.

The Magic of Three: A Better Way to Choose Your Bookkeeping Plan

We’ve designed three monthly bookkeeping packages to meet the needs of real business owners at different stages.

Whether you're just starting out, growing fast, or ready to scale, there's a plan that works for you:

Bronze: The Essentials

Perfect for freelancers or solo operators who want reliable, basic support to stay compliant.

Quarterly P&L reports

One business bank feed maintained

CRA GST/HST filings

1hr/month of email or video support

Focus on your craft — we’ll handle the books.

Silver: Stay Informed

Best for active businesses that need regular insights and multi-account coverage.

Monthly financial reports

Bank, credit card, and LOC feeds maintained

GST/HST filing

QBO included

1hr support + email Q&A

CRA support for non-audit correspondence

Know your numbers, make confident decisions.

Gold: Your Partner in Growth

Ideal for ambitious businesses that want proactive insights and strategic support.

Monthly reports + 1 custom report

Faster delivery (by 10th of month)

Dedicated account rep

2hrs/month of support

Priority CRA communication

Support reminders for mileage/home office tracking

You're not just staying compliant — you're building a better business.

Real Value, Not Just Data Entry

Our goal isn’t to "just do your books."

It’s to give you clarity, confidence, and control.

You’re not buying hours — you’re buying results:

More informed decisions

Better cash flow

Fewer surprises

Peace of mind at tax time

More time to grow (or relax)

Ready to Take Bookkeeping Off Your Plate?

Don’t wait for tax season to realize your books are a mess.

Let’s clean it up now — and keep it clean, month after month.

Book a consultation

We’ll walk you through the options and recommend the best fit for your business.